By, Tracy Emmerich & Tracy Long

The California legislature saw fit to pass several employment laws that will go into effect on January 1, 2024 and beyond. As always, Leap Solutions is here to help you face them proactively and confidently. Our HR professionals have the knowledge, expertise, and resources to inform and guide you through ever-changing legislation and empower your company to thrive in 2024 and beyond.

In this issue of our newsletter:

- 2024 Minimum Wage

- Updates on Current and New Legislative Bills

- Meal and Rest Break Premium Pay

- Ongoing Mandatory Harassment Prevention Training

- Employee Handbook Review/Updates

- Injury and Illness Prevention Program and COVID Prevention Plan

- California Labor Law Posters

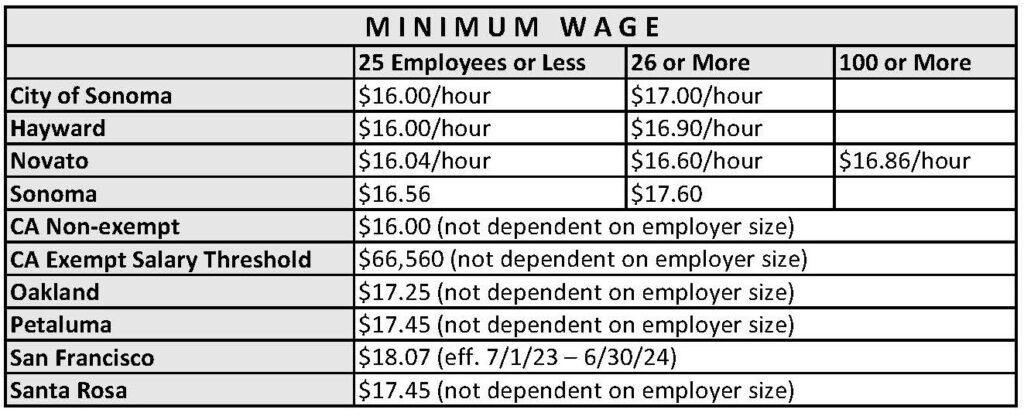

2024 MINIMUM WAGE

January 1, 2024 brings another increase in the California state hourly minimum wage for both non-exempt and exempt salary workers. Due to the increased annual inflation rate, the minimum wage was increased to $16.00 per hour regardless of the number of workers employed by an employer. The exempt salary threshold is two times the minimum wage, therefore, it increases to $66,560 for employers regardless of the number of workers employed.

Local (city and county) non-exempt minimum wage ordinance changes became effective July 1, 2023 to June 30, 2024. We recommend that a compensation review be conducted as soon as possible to ensure that you have identified those in your workforce who need to be brought to the minimum. Your review may reveal wage compression or other issues that you may want/need to address.

UPDATES ON LEGISLATIVE BILLS

The following is a summary of recent legislation and is not intended as legal advice.

New I-9 Form

Effective 11/1/2023 – Applies to All Employers

The new Form I-9, Employment Eligibility Verification, which was released on August 1, 2023, must be used for all new hires, effective November 1, 2023. Some of the changes include reducing sections 1 and 2 to one page. The Lists of Acceptable Documents page has been revised to include acceptable receipts in addition to physical documents. The updated Form I-9 also provides guidance and links to information on automatic extensions of employment authorization documentation. The new I-9 form is available in on the USCIS website (www.uscis.gov).

What this could mean for you: Update new hire packets to include the new I-9 form.

SB 616: Paid Sick Leave Expansion

Effective 1/1/2024 – Applies to All Employers

Under the current Paid Sick Leave, all employers are required to provide up to 24 hours or three days (whichever is greater) of paid sick leave per year. Under the new law, employers will be required to increase that amount to 40 hours per year. Employers may still front load the hours at the beginning of the year with no carry over or accrue paid sick leave based on hours worked (one hour for every 30 hours worked) with two times the annual accrual capped at 80 hours or 10 days (whichever is greater). Employers who front load paid sick leave or accrue based on payroll cycles (not actual hours worked) must ensure that an employee has no less than 24 hours by their 120^th day and an additional 16 hours (40 annual hours) of accrued sick leave by their 200th calendar day of employment. Employers using the accrual method with a cap of 80 hours can still limit employees paid sick leave to 40 hours or 5 days per year, whichever is greater. In addition, SB 616 extends some protections to these

employees covered by a collective bargaining agreement such as covered uses, replacement worker prohibition, and anti-retaliation protections.

What this could mean for you: Review and update existing handbook policies/practices and forms to ensure that employees are aware of the expanded paid sick leave expansion.

SB 848: Reproductive Loss Leave

Effective: 1/1/2024 – Applies 5+ Employees

SB 848 adds to California’s bereavement leave policy by allowing employees who have worked for the company for at least 30 days to use leave for a “reproductive loss event,” which is defined as “the day or, for a multiple-day event, the final day of a failed adoption, failed surrogacy, miscarriage, stillbirth, or an unsuccessful assisted reproduction.” Employers with 5 or more employees will be required to provide up to five days of leave for a reproductive loss event. The law limits the amount of reproductive loss leave to a maximum of 20 days within a 12-month period should an employee experience multiple losses in a 12-month period. Eligible employees must take the leave within three months of the triggering event; however, the leave does not need to be taken on consecutive days. Leave under the statute is unpaid, unless the employer has an existing policy requiring paid leave. Eligible employees may choose to use any accrued and available sick leave, or other paid time off, for reproductive loss leave.

What this could mean for you: Review and update existing handbook policies/practices and forms to ensure that employees are aware of the expanded leave expansion.

AB 2188, SB 700: Cannabis Employment Discrimination

Effective: 1/1/2024 – Applies to All Employers

This new protection prohibits discrimination based on the person’s use of cannabis off the job and away from the workplace, which includes an employer-required drug screening test that has found the person to have “non-psychoactive” cannabis metabolites in their hair, blood, urine, or other bodily fluids. In addition, an employer cannot request information from a job applicant relating to the applicant’s prior use of cannabis, including in the applicant’s criminal history. Exceptions apply for certain trades and where federal laws require applicants or employees to be tested for controlled substances. An employer may discriminate in hiring, or any term or condition of employment, or otherwise penalize a person based on scientifically valid preemployment drug screening that do not screen for non-psychoactive cannabis metabolites.

What this could mean for you: Employers may need to look for alternative testing to determine impairment. Employers may still maintain a drug-free and alcohol-free workplace policy where employees may not possess, be impaired by, or use cannabis on the job.

SB 699, AB 1076: Non-Compete Agreements Unlawful

Effective: 1/1/2024 – Applies to All Employers

Most noncompetition agreements are unenforceable in California. Agreements that restrict an employee’s ability to pursue similar employment after leaving a job are prohibited unless a noncompetition agreement clearly falls under one of the following exceptions:

- Trade secrets protections, which can legally restrict an employee’s ability to use confidential information or company-defined trade secrets.

- Sale of a business, which can legally restrict a seller’s ability to compete with the buyer in the geographic location where the seller had carried on his/her business.

- Dissolution of a partnership, which can legally define a geographic area within which one of the partners cannot conduct a similar business.

The new statute creates a private right of action for employees whose agreements include restrictive covenants for any current, former, or even prospective employee who successfully brings suit over an employer’s use of those restrictive covenants. An employer that may have included a noncompete clause in an employment contract, requires the company to issue a notice to all current and former employees who were employed after January 1, 2022, that the noncompete clauses in their contracts are void. The deadline for this notice is February 14, 2024.

What this could mean for you: Employers should review any non-compete agreements and send out the required notices by February 14, 2024 if applicable.

Cal. Code Regs. Tit. 2, § 11017.1.: Criminal History Inquiries

Effective: 7/1/2024 – Applies to All Employers

New regulations prohibit employers from inquiring into, considering, distributing, or disseminating information related to the criminal history of an applicant until after the employer has made a conditional offer of employment to the applicant. If an employer intends to deny an applicant the employment position they were conditionally offered based solely or in part on the applicant’s conviction history, the employer must first conduct an individualized assessment to determine if there is a direct and adverse relationship with the specific duties of the job that justify denying the applicant the position and that it is job-related and consistent with business necessity. If, after conducting an individualized assessment, an employer makes a preliminary decision that the applicant’s conviction history disqualifies them from the employment conditionally offered, the employer shall notify the applicant in writing. Employers must then permit applicants to respond by providing evidence of rehabilitation or mitigating circumstances and/or evidence challenging the accuracy of the conviction history report that is the basis for the preliminary decision to rescind the offer. Employers shall consider any information submitted by an applicant before making a final decision regarding whether to rescind a conditional offer.

What this could mean for you: Employers who conduct criminal background checks should update their background policy and create a procedure for reviewing all background checks for compliance.

SB 553: Workplace Violence Prevention Program

Effective: 7/1/2024 – Applies to All Employers

Under the California Division of Occupational Safety and Health (Cal/OSHA, covered employers will be required to develop and implement a workplace violence prevention plan (WVPP) as part of their required Injury and Illness Prevention Plans (IIPP) by July 1, 2024. Employers will also have to provide training, create workplace violence incident logs, and keep various records for up to five years.

What this could mean for you: Employers should review their current Violence in the Workplace policy and begin to assess relevant factors to determine the risk level your organization faces for workplace violence such as location, previous incidents of violence, the presence of cash on site. Leap will be available to help write your Workplace Violence Prevention Plan and conduct on-site training for your employees to help you stay in compliance.

SB 476: Food Handler Card Costs

Effective: 01/01/2024 – Applies to all Employers

Employees who work in a food facility or mobile food facility (catering or produce trucks, carts, etc.) who are involved in the preparation, storage, or service of food, is a food handler and needs a California food handler card. California requires relevant workers to obtain a food handler card within 30 days of their date of hire. Under SB 476, employers will be required to cover the cost associated with obtaining a food handler card, including the cost of the test, and paying employees at their regular rate of pay for any time spent completing the training and taking the test. Currently employees can complete the training through American National Standards Institute (ANSI). Under SB 476 the California Department of Public Health will be required to post a list or a link to all certified food handler training programs, including the cost of each program on their website by January 1, 2025.

What this could mean for you: Employers should update their written food handler and timekeeping policies to include the employer paying for food handler cards and all time spent in such training and plan how employees should report it on their timesheets.

OTHER EMPLOYMENT LAWS TO KEEP IN MIND FOR 2024

Meal and Rest Break Premium Pay

Applies to All Employers

The burden of meal break compliance proof rests squarely on the employer. It is imperative that non-exempt employees document their meal breaks daily on their time records and that premiums are paid timely. Premiums must be reported on the employee’s pay statement when an employee misses or does not complete their full (at least 30 minutes) meal period. Meal and/or rest break premium pay is considered “wages,” similar to overtime premium pay, reporting time pay, or split-shift pay. Failure to pay can cause expensive waiting time and wage statement penalties. In very limited situations, when the nature of the employee’s duties prevents the employee from being relieved of all duty, certain designated employees may be authorized to work an “on-duty meal period.” (An example would be a lone cashier at a gas station who works the night shift.) An employee will be permitted to take an on-duty meal period only if the nature of their job requires an on-duty meal period, and the employee and the company have agreed, in advance, and in writing, to an on-duty meal period. In this situation, the on-duty meal period will be paid and treated as hours worked.

Ongoing Mandatory Harassment Prevention Training

Applies to 5+ Employers

Employers with five or more employees must provide one hour of sexual harassment prevention training to nonsupervisory employees and two hours of training to employees with supervisory authority. (This includes part-time, temporary, seasonal, and on-call staff as well as independent contractors, workers from staffing agencies, and employees outside of California, although you are only required to train supervisors located in California or those who supervise any California employees.)

- Training must take place within six months of hire or promotion and every two years thereafter.

- Seasonal and temporary employees or employees hired to work less than 6 months, must be trained within 30 calendar days after hire or within 100 hours worked, whichever is earlier.

- Employers are not required to train employees who are employed for fewer than 30 calendar days and work for fewer than 100 hours.

Leap Solutions can provide interactive onsite or online Harassment Prevention training for your employees!

EMPLOYEE HANDBOOK REVIEW/UPDATES

If your employee handbook has not been reviewed in over a year, you may have missed out on important changes that could affect employee retention and increase your liability. Our HR consultants work with you to customize your handbook while ensuring that you and your employees have clear, up-to-date information to inform and to instruct.

INJURY AND ILLNESS PREVENTION PROGRAM AND COVID PREVENTION PLAN

A written, effective Injury and Illness Prevention Program (IIPP) which includes a COVID Prevention Plan (CPP) is required for every California employer. We can develop a plan with you to ensure that you are in compliance!

DON’T FORGET TO UPDATE YOUR CALIFORNIA LABOR LAW POSTERS TO REFLECT 2024 CHANGES!

The California Department of Industrial Relations requires employers to post current information related to wages, hours and working conditions in an area frequented by employees where it may be easily read during the workday. Remote employees also need to receive required notices. CalChamber Store can help> Labor Law Posters

LEAPING FORWARD

The HR professionals at Leap Solutions can demystify these and many other complicated new employment and labor laws for you, your employees and your hiring managers and supervisors. Count on us to guide you through the complexities of each new piece of legislation and help you respond efficiently, reduce legal risk, minimize expenses, and achieve the peace of mind that comes with keeping your organization compliant and your people safe, strong, and successful.

Are You Ready to Leap into 2024?

*****

Leap Solutions is a diverse group of highly skilled management, organizational development, and human resources, and executive search and recruitment professionals who have spent decades doing what we feel passionate about helping you feel passionate about what you do. Our HR specialists can help you get a handle on the ever-changing COVID-19 guidelines, programs, and legislation that may impact you and your employees. We are available to work with you to develop practical solutions and smart planning decisions for your organization’s immediate, near, and long-term needs.

To print this article, Click Here

![]()